Pet Insurance in USA

intro:- Pet insurance is a smart way to protect your pet’s health while managing the rising costs of veterinary care. Just like health insurance for humans, pet insurance helps cover unexpected medical expenses, including treatments for accidents, illnesses, surgeries, and prescriptions. It can save you from significant out-of-pocket costs and provide peace of mind knowing your pet can receive the best care possible. With various plans available, it’s essential to choose one that fits your pet’s needs and your budget. Pet insurance ensures that you’re prepared for the unexpected, allowing you to focus on your pet’s well-being.

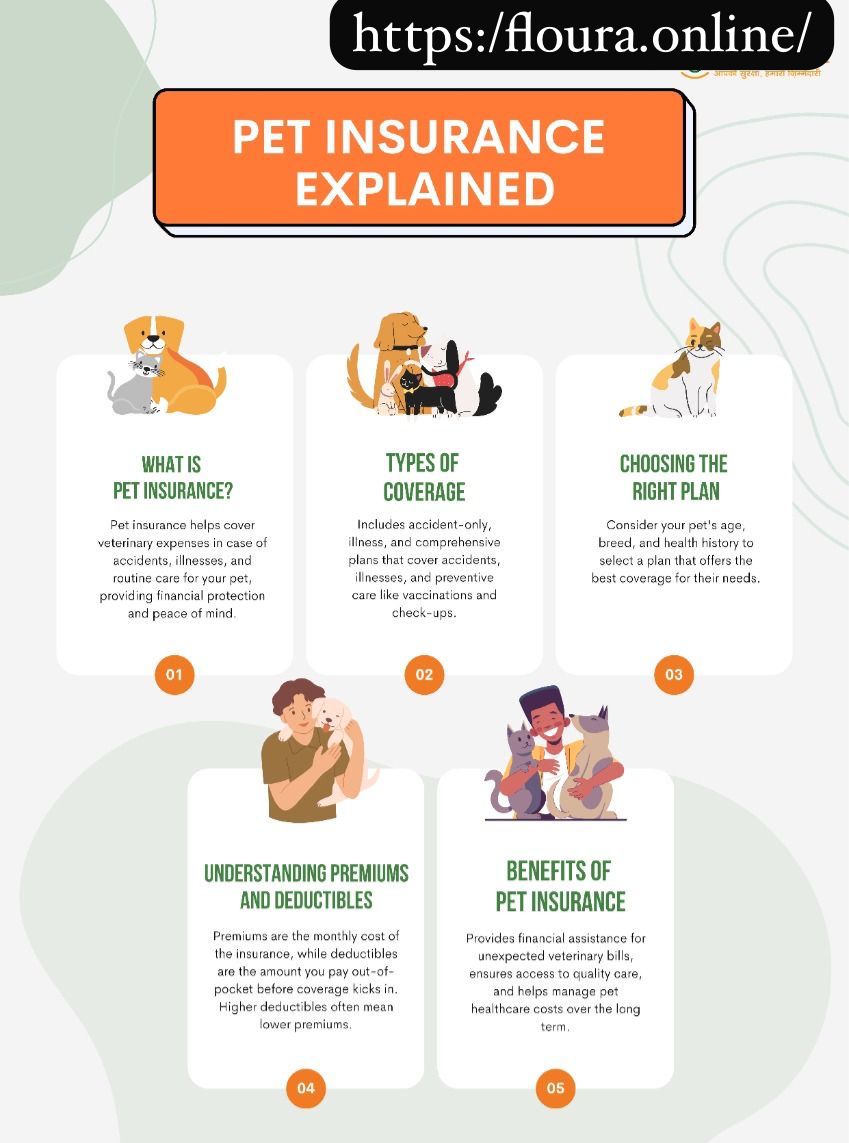

What is Pet Insurance?

Pet insurance is a health coverage plan for pets that helps cover the costs of veterinary care. Similar to human health insurance, pet insurance policies can assist with expenses related to accidents, illnesses, and routine wellness care, depending on the coverage chosen. With rising veterinary costs, pet insurance has become a popular option for pet owners looking to manage expenses while ensuring their pets receive the best possible care.

Why is Pet Insurance Important?

- Financial Protection: Veterinary bills can be expensive, especially in emergencies or for chronic conditions.

- Access to Better Healthcare: Insured pets have a higher likelihood of receiving necessary treatments without financial constraints.

- Peace of Mind: Knowing you can afford the best care for your pet reduces stress and worry.

- Customizable Plans: Policies can be tailored to suit specific needs and budgets.

Types of Pet Insurance Plans

- Accident-Only Coverage: Covers injuries due to accidents such as fractures, cuts, and poisonings.

- Accident and Illness Coverage: Includes accident-related injuries and illnesses like infections, cancer, and chronic conditions.

- Wellness and Preventive Care: Covers routine care, vaccinations, dental cleanings, flea treatments, and annual check-ups.

- Comprehensive Coverage: A combination of all the above, offering the most extensive protection.

Best Pet Insurance Plans for Pets & Senior Pets in 2025

As a pet parent, ensuring your dog gets the best medical care is essential. With rising veterinary costs, pet insurance can be a lifesaver. In 2025, several providers offer excellent coverage at affordable prices. Here are the top pet insurance plans for dogs this year.

1. Healthy Paws

Healthy Paws offers unlimited lifetime benefits with no caps on claims. It covers accidents, illnesses, hereditary conditions, and alternative treatments. Claims are processed quickly, making it a favorite among dog owners.

2. Lemonade Pet Insurance

Lemonade provides affordable plans starting at around $10/month. It covers accidents, illnesses, and diagnostics. You can also add wellness coverage for preventive care.

3. Embrace Pet Insurance

Embrace stands out with its diminishing deductible feature, reducing costs over time. It covers a wide range of conditions, including dental illness, making it a great choice for dog owners.

4. Figo Pet Insurance

Figo offers customizable plans with 24/7 virtual vet visits. It provides high reimbursement rates and no upper age limits, making it perfect for older dogs.

5. ASPCA Pet Health Insurance

ASPCA Pet Insurance provides comprehensive accident and illness coverage, plus optional wellness add-ons. It’s a solid choice for complete pet care.

Choosing the right pet insurance plan ensures your dog gets the best medical attention without financial stress. Compare plans and pick the best fit for your furry friend in 2025!

Top 5 Cheapest Pet Insurance Plans in the USA

Pet insurance is a great way to protect your furry friend’s health without breaking the bank. With so many options available, finding an affordable plan that still offers good coverage can be challenging. To help you out, we’ve researched and compiled a list of the top five cheapest pet insurance plans in the USA that offer excellent value for your money.

1. Lemonade Pet Insurance

Starting Price: Around $10/month

Lemonade is known for its budget-friendly rates and fast claim processing. It covers accidents, illnesses, diagnostics, and medications. You can also add wellness coverage for routine check-ups. Plus, Lemonade donates a portion of its profits to animal charities!

2. Spot Pet Insurance

Starting Price: Around $10/month

Spot offers customizable plans, allowing pet owners to adjust their deductibles and reimbursement rates to fit their budget. It covers vet visits, surgeries, and even alternative therapies. Spot also provides a 30-day money-back guarantee if you’re not satisfied.

3. ASPCA Pet Health Insurance

Starting Price: Around $10/month

ASPCA Pet Insurance is affordable and offers comprehensive coverage, including accident and illness protection. It also provides optional preventive care add-ons. Their flexible plans make it easier for pet parents to find a policy that works for their needs.

4. Figo Pet Insurance

Starting Price: Around $15/month

Figo is one of the most affordable high-coverage pet insurance options. It offers 24/7 virtual vet visits and cloud-based pet medical records. With no upper age limits, Figo is a great choice for older pets as well.

5. MetLife Pet Insurance

Starting Price: Around $15/month

MetLife offers budget-friendly plans with quick reimbursements and coverage for chronic conditions. Unlike some providers, it has no breed or age restrictions. You can also get discounts if you insure multiple pets.

Finding a cheap pet insurance plan doesn’t mean sacrificing quality. The above options provide affordable yet comprehensive coverage to keep your pet healthy and your wallet happy. When choosing a plan, consider your pet’s needs and compare coverage options to get the best value.

important topic at time of pet insurance

Choosing the right pet insurance can be overwhelming, but keeping a few key factors in mind can help you find the best plan for your furry friend. Here’s what you should consider before making a decision:

1. Coverage Options

Not all pet insurance plans are the same. Some cover only accidents, while others include illnesses, hereditary conditions, and even alternative therapies. Check if the plan covers chronic conditions, dental care, and prescription medications.

2. Exclusions and Limitations

Most insurers do not cover pre-existing conditions, and some have breed-specific exclusions. Read the policy details carefully to avoid surprises when filing a claim.

3. Cost vs. Benefits

Compare monthly premiums, deductibles, and reimbursement rates. A lower monthly premium might mean higher out-of-pocket costs when making a claim, so choose a plan that balances affordability and coverage.

4. Age and Breed Restrictions

Some providers have age limits for enrolling pets, while others charge higher premiums for older animals. Make sure the plan is suitable for your pet’s age and breed.

5. Claim Process and Reimbursement Speed

A fast and hassle-free claims process is essential. Look for insurers with simple online claim submissions and quick reimbursements.

By considering these factors, you can choose a pet insurance plan that provides the best protection for your pet and peace of mind for you.

Who Gets a Claim in Pet Insurance and Who Doesn’t?

Pet insurance helps cover unexpected veterinary costs, but not every claim is approved. Understanding what is covered and what isn’t can save you from unexpected expenses.

Who Gets a Claim Approved?

A pet insurance claim is typically approved if:

- The Condition is Covered: Policies usually cover accidents, illnesses, surgeries, and medications. If your pet is treated for a covered condition, your claim is likely to be approved.

- The Waiting Period is Over: Most insurers have a waiting period before coverage begins. Claims filed after this period are more likely to be accepted.

- You Followed Policy Rules: Some policies require routine checkups and preventive care. Keeping up with these requirements can prevent claim denials.

- You Chose an In-Network Vet (if required): While most pet insurance plans allow any licensed vet, some may have a network.

Who Doesn’t Get a Claim Approved?

A pet insurance claim may be denied if:

- The Condition is Pre-Existing: Most insurers do not cover illnesses that started before the policy began.

- The Treatment is Not Covered: Routine care, cosmetic procedures, and elective surgeries are usually excluded.

- The Policy Lapsed: If you missed payments, your coverage might be inactive.

Understanding these factors can help you avoid claim rejections and get the best value from your pet insurance plan.

Does Pet Insurance Cover Dental Care?

Dental health is a crucial part of your pet’s overall well-being. Many pet owners wonder if pet insurance covers dental care, and the answer depends on the provider and plan you choose.

Most pet insurance policies cover dental accidents and illnesses, such as broken teeth, gum disease, or infections. If your pet suffers a dental injury due to an accident or develops an illness like periodontal disease, many plans will help cover the costs of treatment, extractions, and medication.

However, routine dental cleanings and preventive care are usually not included in standard pet insurance plans. Some providers, like Embrace and ASPCA Pet Insurance, offer wellness add-ons that cover routine dental check-ups, cleanings, and preventive treatments.

If dental care is a priority for you, look for plans that specifically include dental illness coverage, as some policies exclude periodontal disease or age-related dental issues. Additionally, keeping up with regular cleanings can prevent costly dental problems in the future.

To ensure your pet’s teeth stay healthy, compare insurance plans carefully and consider adding a wellness package if routine dental care is not covered. A good pet insurance policy can save you money while keeping your pet’s smile bright and healthy.

American Bully Dog Care & Diet & Complete Guide Tips

What Does Pet Insurance Typically Cover?

- Emergency visits and hospitalizations

- Surgeries and specialist treatments

- Prescription medications

- Diagnostic tests (X-rays, MRIs, blood tests)

- Chronic and hereditary conditions (depending on the policy)

- Alternative therapies (acupuncture, hydrotherapy, chiropractic care)

What is Not Covered in Insurance?

- Pre-existing conditions

- Elective procedures (cosmetic surgeries, ear cropping, tail docking)

- Breeding and pregnancy-related expenses

- Experimental treatments

- Behavioral therapy (unless specifically included in the policy)

How Much Does Pet Insurance Cost in the USA?

The cost of pet insurance varies based on factors such as the pet’s breed, age, location, and coverage plan. On average:

- Dogs: $30 – $50 per month for accident and illness coverage

- Cats: $15 – $30 per month for accident and illness coverage

- Wellness add-ons: Additional $10 – $20 per month

Factors Affecting Insurance Premiums

- Breed: Some breeds are more prone to genetic health issues.

- Age: Older pets have higher premiums due to increased health risks.

- Location: Veterinary costs vary by state and city.

- Coverage Level: More comprehensive plans cost more.

- Deductibles and Reimbursement Rate: Higher deductibles lower monthly premiums, while higher reimbursement rates increase them.

Top Insurance Providers in the USA

- Healthy Paws: Best for comprehensive coverage with unlimited benefits.

- Embrace: Offers customizable plans with wellness add-ons.

- ASPCA Pet Health Insurance: Known for accident and illness coverage with multiple options.

- Spot Pet Insurance: Provides flexible plans and 24/7 vet helpline.

- Pumpkin Pet Insurance: Offers extensive coverage, including preventive care.

How to Choose the Right Insurance Plan

- Assess Your Pet’s Needs: Consider breed-specific health risks and lifestyle.

- Compare Plans: Look at coverage options, exclusions, and reimbursement rates.

- Check Customer Reviews: See real experiences from other pet owners.

- Understand Policy Terms: Read Complete fine print to avoid surprises.

- Consider the Waiting Period: Most policies have a waiting period before coverage begins.

Is Pet Insurance Worth It?

Pet insurance is a valuable investment if you want to protect your pet and finances from unexpected medical expenses. While it may not always save money in the short term, it can be a lifesaver in cases of emergency treatments, chronic illnesses, or major surgeries.

Flea Treatments for Dogs and Cats: Full Detailed Information

OVERVIEW:- Pet insurance in the USA provides pet owners with financial security and ensures pets receive the best possible care. With various plans available, it’s important to research and choose a policy that suits your pet’s needs and your budget. By investing in pet insurance, you can enjoy peace of mind knowing your furry friend is protected in times of need.

Pet insurance is a valuable investment in your pet’s health and your peace of mind. With rising veterinary costs, having coverage can make a significant difference when your pet faces unexpected health issues. It can help reduce financial stress by covering treatments for accidents, illnesses, and even chronic conditions.

However, it’s important to choose a plan that suits your pet’s needs and your budget. Carefully consider the coverage options, exclusions, premiums, and deductibles before committing to a policy. While pet insurance doesn’t cover everything, it can still help with major medical expenses and provide access to high-quality care.

Ultimately, pet insurance is about being prepared for the unpredictable. By planning ahead, you ensure that your pet receives the best care without breaking the bank. Investing in pet insurance is a responsible choice for any pet parent looking to protect their furry friend’s health.

Lucky & Unlucky Pet According Birth Dates